iowa transfer tax calculator

The tax is paid to the county recorder in the. Transfer Tax Calculator Iowa Real Estate Transfer Tax Description.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property.

. Calculate the real estate transfer tax by entering the total amount paid for the property. Calculate the real estate transfer tax by entering the total amount paid for the property. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Transfer Tax Tables 1991-Present Online Services. Returns either Total Amount Paid or Amount Due. You can also find the total amount paid by entering the revenue tax stamp paid.

The tax is imposed on the total amount paid for the property. If you are a bank law firm or abstract company interesting in e-filing then we can help. This calculation is based on 160 per thousand and the first 500 is exempt.

Calculate Iowa Real Estate Transfer Tax Calculator. What is Transfer Tax. Plymouth County Iowa Making Life Better for all.

Iowa charges a transfer tax of 016 with. You can also find the total amount paid by entering the revenue tax stamp. This calculation is based on 160 per thousand and the first 500 is exempt.

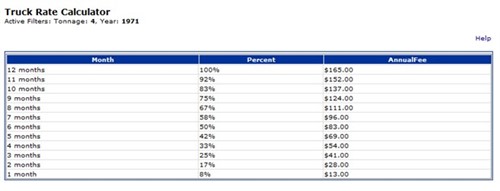

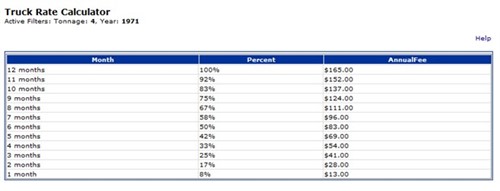

You can also find the total amount paid by entering the revenue tax stamp paid. Real Estate Transfer Tax Calculator. If you know the Year Make and Model key in Year.

Enter the amount paid in the top box the rest will autopopulate. Tools for estimating Iowa property tax and real estate transfer tax. The calculation is based on 160 per thousand with the first 500 being exempt.

Returns either Total Amount Paid or Amount. You can also find the total amount paid by entering the revenue tax stamp paid. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. Calculate the real estate transfer tax by entering the total amount paid for the property. With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

Type your numeric value in either the Total Amount Paid or Amount Due boxes. To find out more information Click. Iowa IA Transfer Tax.

Calculate the real estate transfer. This calculation is based on 160 per thousand and the first 50000 is exempt. This feature is used to determine registration fees by vehicle identification number or by selecting make year and model.

Iowa Real Estate Transfer Tax Calculator. You may calculate real estate transfer tax by entering the total amount paid for the property. This means that the combined transfer tax rate in Chicago is 120 while the rest of Illinois has a transfer tax rate of 015.

The tax is imposed on the total amount paid for the property. Calculate real estate transfer tax by entering the total amount paid for the property or find the total amount paid by entering in the revenue tax stamp paid. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt.

To view the Revenue Tax Calculator click here. Real Estate Transfer Tax Calculator. You can also find the total amount paid by entering the revenue.

This Calculation is based on 160 per thousand and the first 500 is exempt. Amount Due You may calculate real estate transfer tax by entering the total amount paid for the property. The tax is paid to the county recorder in the county where.

This calculation is based on 160 per thousand and the first 500 is exempt. Calculate the real estate transfer tax by entering the total amount paid for the property. Monroe County Iowa - Real Estate Transfer Tax Calculator.

This calculation is based on 160 per thousand and the first 500 is exempt. Adair County Iowa 400 Public. Real Estate Transfer Tax Calculator.

Total Amount Paid Must be. You can also find the total amount paid by entering the revenue tax stamp. Calculate the real estate transfer tax by entering the total amount paid for the property.

Real Estate Transfer Tax Calculator. You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first. You can also find the total amount paid by entering the revenue tax stamp.

Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate.

Cryptocurrency Taxes What To Know For 2021 Money

Income Tax Calculator 2021 2022 Estimate Return Refund

Calculate Your Transfer Fee Credit Iowa Tax And Tags

North Carolina Sales Tax Calculator Reverse Sales Dremployee

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Jackson County Iowa Real Estate Transfer Tax Calculator Jackson County Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Property Tax Calculator Casaplorer

Pin On Tax Lien Tax Deed Blogs

New Hampshire Property Tax Calculator Smartasset

Transfer Tax In Marin County California Who Pays What

Transfer Tax In San Luis Obispo County California Who Pays What

Transfer Tax Alameda County California Who Pays What

How To Charge Your Customers The Correct Sales Tax Rates

Monroe County Iowa Transfer Tax Calculator